Built for Accountants, IFAs & Business Advisors

Help Your Clients Exit with Confidence

FREE tools to uncover risks, improve value, and guide clients to a smoother, more profitable business exit.

Practical Support. Real Results.

Why Advisors Use This Toolkit

Supporting a business owner through an exit isn’t just about numbers — it’s about clarity, timing, and trust.

This toolkit helps you lead the conversation, reduce risk, and stay at the centre of the client relationship.

Use it to:

Start smarter, future-focused conversations

Spot exit risks before they become dealbreakers

Add immediate value without adding workload

Stay visible and relevant during key client decisions

Access expert support when needed — without losing the client

REAL-WORLD TOOLS. PRACTICAL OUTCOMES.

Built by an M&A Advisor Who Supports Advisors

Hi — I’m Ased Iqbal, founder of Thinkerz.

I’ve helped dozens of business owners and advisors through exits, valuations, and strategic transitions.This toolkit was built to make your job easier —

So you can guide your clients through smoother exits, uncover hidden risks early, and deliver value long before they decide to sell.Even if you’re not an M&A expert, these tools make you look like one.

.

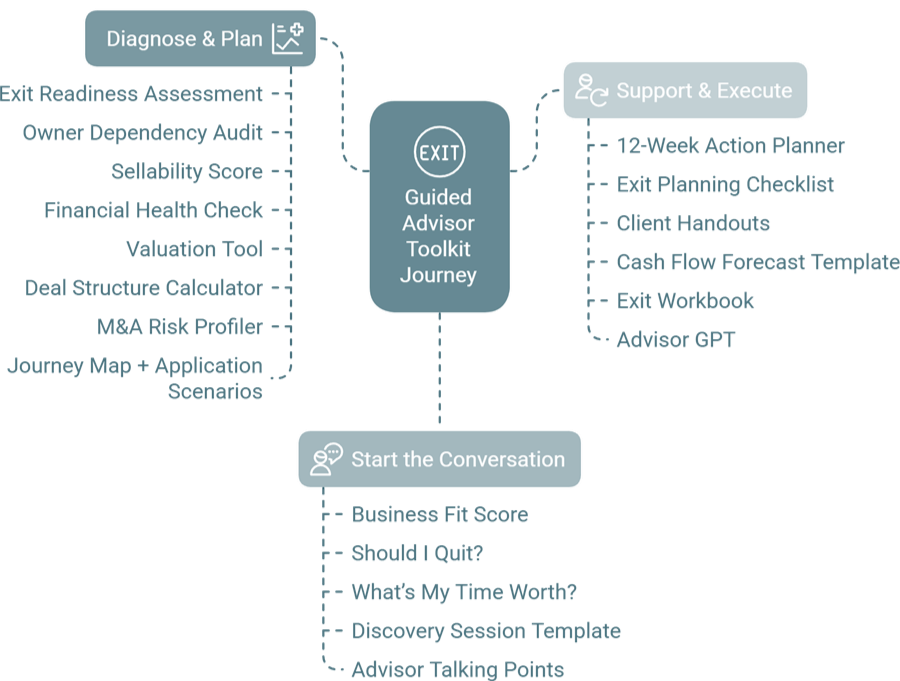

Start Here – Your Guided Advisor Toolkit Journey

Not Sure Where to Start?

Use this simple 3-stage journey to guide your clients from early doubt to exit-ready — using the right tools at the right time.

Stage 1: Start the Conversation

Spot the signs. Open the door to exit planning.

Business Fit Score →

See if the business still fits the owner’s life and goals.

Should I Quit →

Self-assess emotional readiness and future direction.

What's My Time Worth →

Quantify owner time and role value.

Discovery Session Template →

Run a 30–45 min first conversation.

Advisor Talking Points →

Openers, key questions, and language prompts.

Stage 2: Diagnose & Plan

Assess the business. Spot gaps. Plan forward.

Exit Readiness Assessment →

Understand how close to exit-ready they are.

Owner Dependency Audit →

Evaluate key man risk.

Sellability Score →

Quick client-facing view of market appeal.

Financial Health Check →

Check liquidity, margin, and balance sheet.

Valuation Tool →

Sector-adjusted benchmark valuation.

Deal Structure Calculator →

Test funding splits and deferred terms.

M&A Risk Profiler →

Spot risk factors that can derail a deal.

.

Stage 3: Support & Execute

Guide your client through the exit process.

12-Week Action Planner →

Give your client weekly priorities and tasks.

Exit Planning Checklist →

Step-by-step roadmap toward a sale.

Client Handouts (Value, Timing, Risk) →

Ready-made PDFs for client education.

Cash Flow Forecast Template →

Model different deal payment structures.

Exit Workbook →

Everything in one editable resource.

Advisor GPT →

Instant answers, scripts, and tool guidance.

Not Sure Where to Begin?

Use our quick Tool Recommender to find the right starting point based on your client’s situation.

Guided Advisor Toolkit Journey - (a visual map)

This quick visual shows how to begin — and how the core tools fit together. Share it with clients or use it as a simple engagement roadmap.

.

Guided Framework PDF

Everything in One Place – Use the Toolkit with Confidence

Want a simple summary of how to use the Advisor Toolkit with clients?

This 2-page printable guide maps out all the tools and resources by stage, showing exactly when and how to use them.

See the full 3-stage journey

Match tools to where your client is

Understand what each tool does

Get practical guidance in plain English

Need Workbooks, Scripts, or Templates?

Explore practical, ready-to-use resources to guide your advisory sessions — from full client workbooks to checklists, explainer guides, and conversation scripts.

Need help choosing the right tool?

Want support with a client conversation?

Ask Advisor GPT

Advisor GPT is your AI assistant — trained on all six Advisor Toolkit tools and resources.

It helps you match the right tool to the right moment and gives you practical, no-fluff support for real-world advisory work.

Free to use. No login required.

.

Thinking About Stepping Back?

Before your client talks numbers, they often need to explore what they’re really feeling. These tools help start the conversation — gently.

Should I Quit?

A light-touch self-assessment to help clients reflect on work satisfaction, stress, and direction. Great for clients feeling stuck, restless, or burned out.

Business Fit Score

Helps owners reflect on whether the business still fits their goals, energy, and life. Use before diving into exit planning.

.

What’s My Time Worth?

A quick calculator that shows the true value of a business owner’s time based on income goals, working hours, and personal targets.

Why it Matters

Without the Toolkit

Missed risks that could kill a deal

Vague conversations around exit timing or value

Lower perceived value from your advice

No structure to move the client forward

The Diference A Toolkit Makes

With the Toolkit

Spot risks early — before due diligence does

Lead confident, value-driven conversations

Become the advisor they trust to guide big decisions

Help clients exit well — without adding more to your plate

Want to explore partnership?

Here’s the next step

Access the Advisor Pack

See how we support accountants, IFAs, and consultants with hands-on, strategic exit planning — without adding to your workload or risk.

Want to Talk Exit, Strategy, or Support?

Get In Touch

Have a client preparing for exit? Curious about using the toolkit in your practice? Reach out — no hard sell, just a helpful conversation.

.

Advisors Toolkit

Tools to help you assess value, identify risks, and prepare for a stronger exit.

Owner Dependency Audit

Find out how replaceable your client really is — and what that means for value.

Get a clear score, traffic-light risk level, and practical next steps to reduce buyer concerns.

Sellability Score Tool

Quickly gauge how attractive the business is to a serious buyer — and what’s holding it back.

Get a clear score across 10 key value drivers and simple recommendations to improve buyer appeal.

Business Valuation Tool

Find out what the business could realistically be worth — in minutes.

Use sector-adjusted multiples and your client’s EBITDA to generate a quick, commercial valuation — no logins, no spreadsheets, no fluff.

Exit Readiness Assessment

Find out how far the business really is from a successful exit — and what’s missing.

Get a clear, shareable score across financial, operational, legal, and personal factors, plus actionable steps.

Financial Health Check

Quickly assess your client’s financial strength — no spreadsheets, stress, or number crunching needed.

Answer 12 yes/no questions to generate a Financial Health Score and highlight key areas that may need attention or improvement.

M&A Risk Profiler

Spot potential deal risks early — before legal fees, time, or credibility get wasted.

Get an instant red flag profile across five core risk areas including financials, legal, operations, market factors, and integration risks.

“Finally — practical tools I can use with clients that don’t need logins, subscriptions, or hand-holding.”

– Designed for busy professionals

“This toolkit helps me have smarter, faster conversations around succession, value, and risk.”

– Built from real-world M&A experience

“Advisors are the first people business owners turn to. These tools make sure we’re ready when they do.”

– Focused on real outcomes, not theory

See How It All Fits Together

The Exit Journey – Tools for Every Stage

Which Tool Should I Use?

| Tool | Use It When... | Best For... | Use Tool |

|---|---|---|---|

| Owner Dependency Audit | The owner is deeply involved in daily ops | Succession planning, identifying key-person risk | Use Tool → |

| Sellability Score Tool | You want to assess buyer appeal | Exit conversations, value driver benchmarking | Use Tool → |

| Exit Readiness Assessment | You want a big-picture readiness score | Planning the exit timeline, prioritising gaps | Use Tool → |

| Valuation Estimator | The client wants a quick value benchmark | Early-stage valuation planning | Use Tool → |

| M&A Risk Profiler | Assessing a live or potential deal | Deal review, early red flag scanning | Use Tool → |

| Financial Health Check | You need a basic financial pulse check | Client onboarding, quick financial clarity | Use Tool → |

Advisor Exit Workbooks

Structured workbooks to support advisors at every stage of the client journey — from planning to action.

Reference Edition

A full walkthrough of the Advisor Toolkit — includes tools, guidance, and when to use what.

Ideal for onboarding, training, or planning your approach.

Interactive Edition

A fillable client workbook to track progress, notes, and outcomes — designed for advisors to use live.

Ideal for working sessions and building client clarity.

Advisor Learning Path (Self-Guided)

A practical walkthrough of each tool and workbook — what it does, how to use it, and when to introduce it with clients.

.

Advisor Toolkit Resources

Structured guides, templates, and handouts to help you support your clients at every stage of the exit journey.

Using the Toolkit

Toolkit Application Scenarios

Choose the right tool for the right client situation.

Exit Conversation Starter Guide

Open the exit discussion with confidence — without overwhelming your client.

.

Toolkit Quick Reference Sheet

One-page summary of all 6 core tools — what they do and when to use them.

Advisor Talking Points Guide

Phrases and prompts to introduce exit conversations naturally.

Running Advisory Sessions

Discovery Session Template

A 30–45 minute structure for your first exit conversation.

Owner Transition Planner

Help clients systemise and delegate ahead of exit.

.

Exit Readiness Discussion Script

Walk through readiness without pressure — light framing with tool links.

Advising Time-Poor Business Owners

Ways to engage busy clients without adding pressure.

Client-Facing Handouts

Client Exit Prep Checklist

A self-check guide for early-stage preparation.

How Buyers Fund a Deal

Explains how buyers structure acquisition funding — bank debt, equity, etc.

Explaining Earn-Outs to Clients

Clear guidance for understanding how performance-based payments work.

Understanding Owner Dependency Risk

Explains why high reliance on the owner reduces value, and what business owners can do to fix it.

Deal Structure Explainer

Breaks down SME deal types — earn-outs, deferred, seller finance.

Realistic Value vs. Cash at Close

Helps manage expectations — value ≠ cash day one.

What to Expect in the Exit Process

A clear walkthrough of the four key phases in an SME exit: preparation, go-to-market, negotiation, and transition.

Timeline Considerations for Exit

Helps clients understand how long exit planning really takes — and why starting early makes all the difference.

What Buyers Want – Client Handout

A summary of what serious buyers look for (beyond the numbers).

Post-Exit Planning Questions for Advisors

Support clients post-deal — financial, emotional, and lifestyle prompts.

5 Key Factors That Impact Business Value

Highlights the top drivers that influence valuation — from recurring revenue to growth potential.

Closing the Value Gap

Explains the difference between current and potential business value — and how owners can work toward a more profitable, strategic exit.

.

Timeline & Journey Resources

Why Exit Planning Starts Early

Why planning 2–3 years ahead unlocks better exits.

12-Week Exit Action Planner

Light weekly structure to improve readiness and reduce risk.

M&A Journey Map + Tool Match

A full breakdown of the exit journey — with tool alignment.

Helping Clients Adjust After Exit

Guidance for navigating post-sale life and emotional shifts.

.

Exit Planning Checklist

A broad checklist to assess how exit-ready a business is.

Industry-Specific Guidance

Exit Planning for Manufacturing Businesses

Reduce owner reliance, document key processes, and prepare for asset-heavy due diligence.

Exit Planning for B2B Product-Based Services

Address customer concentration, supplier risk, and improve working capital structure.

.

Exit Planning for Professional Services

Minimise personal goodwill risk and build scalable systems around delivery and talent.

Broker & Deal Stage Guides

Working With Brokers – What to Expect

Helps clients understand what a broker does (and doesn’t).

What to Expect After Heads of Terms

Explains what happens post-HoT and how to support the client.

.

Questions to Ask a Broker

Filters the good from the bad — before signing a mandate.

Deal Red Flag Checklist

Helps clients identify issues that scare off buyers.

Advisor Tool Implementation Guides

Exit Readiness Assessment

Understand what the score means across the five pillars of readiness, and how to prioritise next steps in your client’s exit journey.

Financial Health Check

Assess the strength of a client’s reporting, controls, and readiness for due diligence — and highlight financial blind spots.

.

Owner Dependency Audit

Identify where a business is overly reliant on the owner and guide the client toward a more transferable, succession-ready model.

M&A Risk Profiler

Use the colour-coded risk categories to guide smarter deal decisions, avoid surprises, and focus due diligence where it matters most.

Sellability Score Tool

Unpack the qualitative drivers of buyer interest and show clients how to improve their sale appeal beyond just financials.

Valuation Tool

Frame valuation discussions around logic and market expectations — not emotion. Learn how to interpret the result and set realistic positioning.

Financial Templates

Downloadable Excel and Word tools to support deal prep, structure, and presentation.

Normalised EBITDA Template

Adjust reported profit for add-backs and normalisations — includes footnotes and multi-year structure.

Heads of Terms Template (UK)

Editable Word doc covering key deal elements — price, conditions, exclusivity, and timeline.

Earnings Quality Checklist

Evaluate how reliable and defensible a business’s reported earnings really are — a key factor in valuation and buyer confidence.

.

Deal Structure Calculator

Break down a deal into upfront, deferred, and earn-out components. Includes £ output.

Financial Summary Pack Template

One-page buyer-ready summary: financials, metrics, staff, and deal highlights.

Net Proceeds Calculator

Helps sellers understand what they’ll actually receive after debt, tax, and deal costs — not just the headline price.

Working Capital Adjustment Template

Track assets and liabilities across 3 years and calculate surplus/shortfall vs. target.

Exit Planning Progress Tracker

A structured tracker to monitor client progress across all 7 exit stages. Use it to guide priorities, log notes, and keep both client and advisor aligned.

Cash Flow Forecast

A simple 12-month projection tool to help advisors and clients track inflows, outflows, and net cash position in preparation for exit.

Need help choosing the right tool?

Want support with a client conversation?

Ask Advisor GPT

Advisor GPT is your AI assistant — trained on all six Advisor Toolkit tools and resources.

It helps you match the right tool to the right moment and gives you practical, no-fluff support for real-world advisory work.

Free to use. No login required.

Support for Clients in Distress

Helping a Business Owner Under Pressure?

If your client is facing financial stress, team overwhelm, or just needs a clear path forward — the Turnaround Toolkit gives them exactly that.Free tools, guides, and a 12-week restructuring workbook they can use immediately.

Created to support small business owners under real pressure.

Growth Strategy

Unlock Stalled Potential with the Biz Growth Toolkit

For clients who’ve hit a ceiling, this step-by-step toolkit helps identify bottlenecks and reignite momentum across Marketing, Sales, Operations, and Finance — using the proven MSOF framework. A powerful resource to support stuck or plateaued businesses back into forward motion.

FEEDBACK

Have a Thought or Suggestion?

We’re building this toolkit to support real advisors like you — if there’s something missing, confusing, or worth improving, we’d love to hear it.

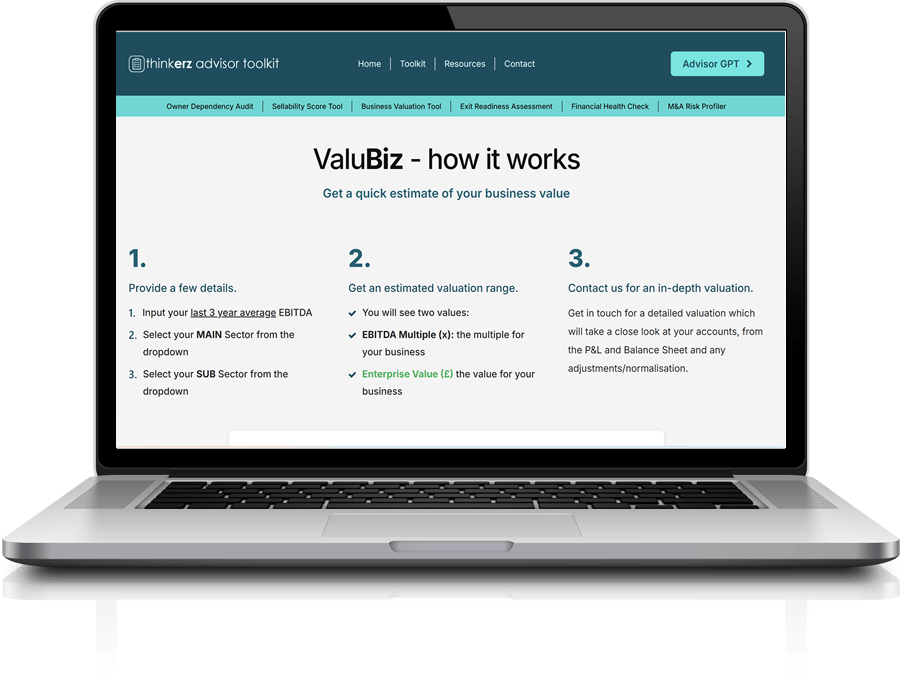

ValuBiz - how it works

Get a quick estimate of your business value

1.

Provide a few details.

Input your last 3 year average EBITDA

Select your MAIN Sector from the dropdown

Select your SUB Sector from the dropdown

2.

Get an estimated valuation range.

You will see two values:

EBITDA Multiple (x): the multiple for your business

Enterprise Value (£) the value for your business

3.

Contact us for an in-depth valuation.

Get in touch for a detailed valuation which will take a close look at your accounts, from the P&L and Balance Sheet and any adjustments/normalisation.

Want advisor guidance on how to use this?

Terms of Use & Disclaimer

The Advisor Toolkit and all associated tools, templates, and resources are provided for general informational purposes only. They are designed to support advisors in guiding their clients through business exit conversations and planning — but they do not constitute legal, financial, tax, or other regulated advice.By using this site and its tools, you acknowledge that:No client-advisor relationship is formed with Thinkerz or Ased Iqbal.You remain solely responsible for any decisions made or advice given to clients.The tools are provided “as-is” with no guarantees, warranties, or liability for outcomes.All financial templates and assessments are illustrative. They are not substitutes for formal due diligence, legal documentation, or regulated advisory processes.If you are unsure about any legal, financial, or tax matter, you should seek appropriate professional advice.

Thanks — You're All Set

Your toolkit results have been submitted, and a copy is on its way to your inbox (if requested).

What You Can Do Next:

Explore the other tools in the Advisor Toolkit

Visit the Advisor Resources page

Book a free 30-min call if you’d like help applying this with a client

Reach out any time: [email protected]